All Eyes On Supreme Court In Advance Of Earnings Parade

Jan 12, 2026

•

dub Advisors' Top Performing Portfolios Last Week

PRECIOUS +5.62%. Silver (SLV, 21.0%) led with 10.1% gain amid supply fears from China's January 1 export licensing restrictions covering 60-70% of global refined silver supply. Palladium (PALL, 2.0%) jumped 11.6% on tight supply and pending U.S. Commerce anti-dumping ruling on Russian imports. Platinum (PPLT, 8.4%) gained 6.3% on persistent supply deficits. Gold (GLD, 68.5%) rose 4.1% to ~$4,445/oz after U.S. captured Venezuelan President Maduro January 3-4, triggering safe-haven flows.

AIPOWER +5.60%. Bloom Energy (BE, 10.7%) surged 35.8% on AI data center power demand, with HSBC adding to top picks. Oklo (5.0%) jumped 35.4% after announcing 1.2 GW nuclear deal with Meta—part of Meta's landmark 6.6 GW package January 9. NuScale (SMR, 7.8%) rose 25.8% following DOE's $2.7B uranium enrichment investment January 5. Centrus (LEU, 9.8%) gained 12.4% on $900M DOE task order January 6. GE Vernova (9.7%) fell 8.4% on Baird downgrade to Neutral.

ANTICRAMER +5.21%. Lithium Americas (LAC, 38.8%) led at 13.0% as China lithium carbonate prices rose 20%+ in early January. Whirlpool (WHR, 8.3%) surged 12.0% on tariff tailwinds with 80% domestic U.S. production versus ~25% for competitors. Medical Properties Trust (MPW, 3.6%) rose 6.7% on 12.5% dividend increase to $0.09/share and $150M share repurchase program. AMC (17.4%) gained 1.9% on strong holiday performance.

FASHION +4.35%. Capri (CPRI, 7.9%) led at 7.1% after Citigroup reinstated Buy with $31 target January 5. Estée Lauder (EL, 18.8%) rose 6.5% after Raymond James double-upgraded to Strong Buy with $130 target January 5. Revolve (RVLV, 13.6%) gained 4.2% on Zacks Strong Buy upgrade, and Tapestry (TPR, 22.9%) rose 4.1% on multiple analyst target increases.

CRYPTOCORP +4.27%. Riot (8.2%) led at 8.2% after announcing January 2 shift to data center revenue metrics and CFO transition. Core Scientific (CORZ, 8.4%) rose 7.2% on BTIG Buy upgrade citing undervaluation at ~$4M/MW versus ~$7M/MW peer average. Marathon (MARA, 12.0%) gained 3.1%, and Coinbase (COIN, 31.3%) rose 1.8% after CEO announced "everything exchange" strategy January 1.

The Jobs Market Is Our Achilles Heel

The stock market ended its first full trading week of 2026 with impressive gains, as the S&P 500, Dow Jones Industrials, and Russell 2000 closed at new all-time highs on Friday. Investors are anticipating better-than-expected earnings for the fourth quarter, fiscal stimulus in the form of tax breaks from the One Big Beautiful Bill Act, and additional rate cuts from the Federal Reserve, all of which should support higher risk asset prices. Yet the news isn’t all good, as last week’s jobs report for December revealed.

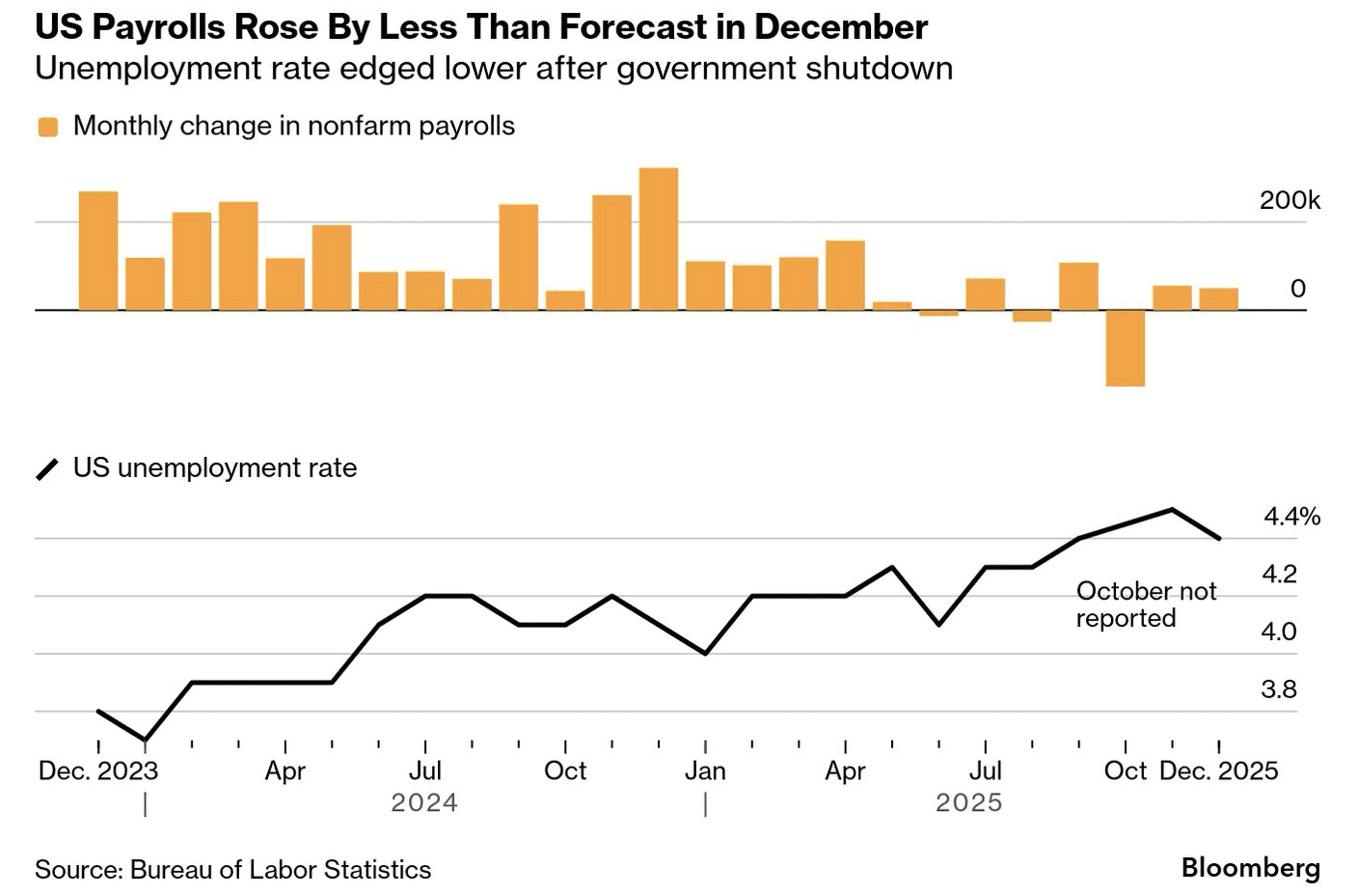

According to the Bureau of Labor Statistics, the economy created just 50,000 jobs last month, which brings the total for last year to 584,000. That is the lowest number since 2009 outside of the pandemic and well below the more than two million created in 2024. This stagnation, which is the Achilles heel of the economic expansion, has been caused by multiple factors, including immigration policy, displacement from AI development, and tariffs.

The manufacturing sector lost 68,000 jobs last year. Industry executives who respond each month to the manufacturing surveys conducted by the Institute for Supply Management and S&P Global have repeatedly indicated that tariffs have raised input costs, increased uncertainty, and dampened hiring. Executives from the much larger service sector have voiced similar concerns. This is why investors are hyper focused on a ruling from the Supreme Court, which could come as early as Wednesday.

The Supreme Court Will Rule On Tariffs

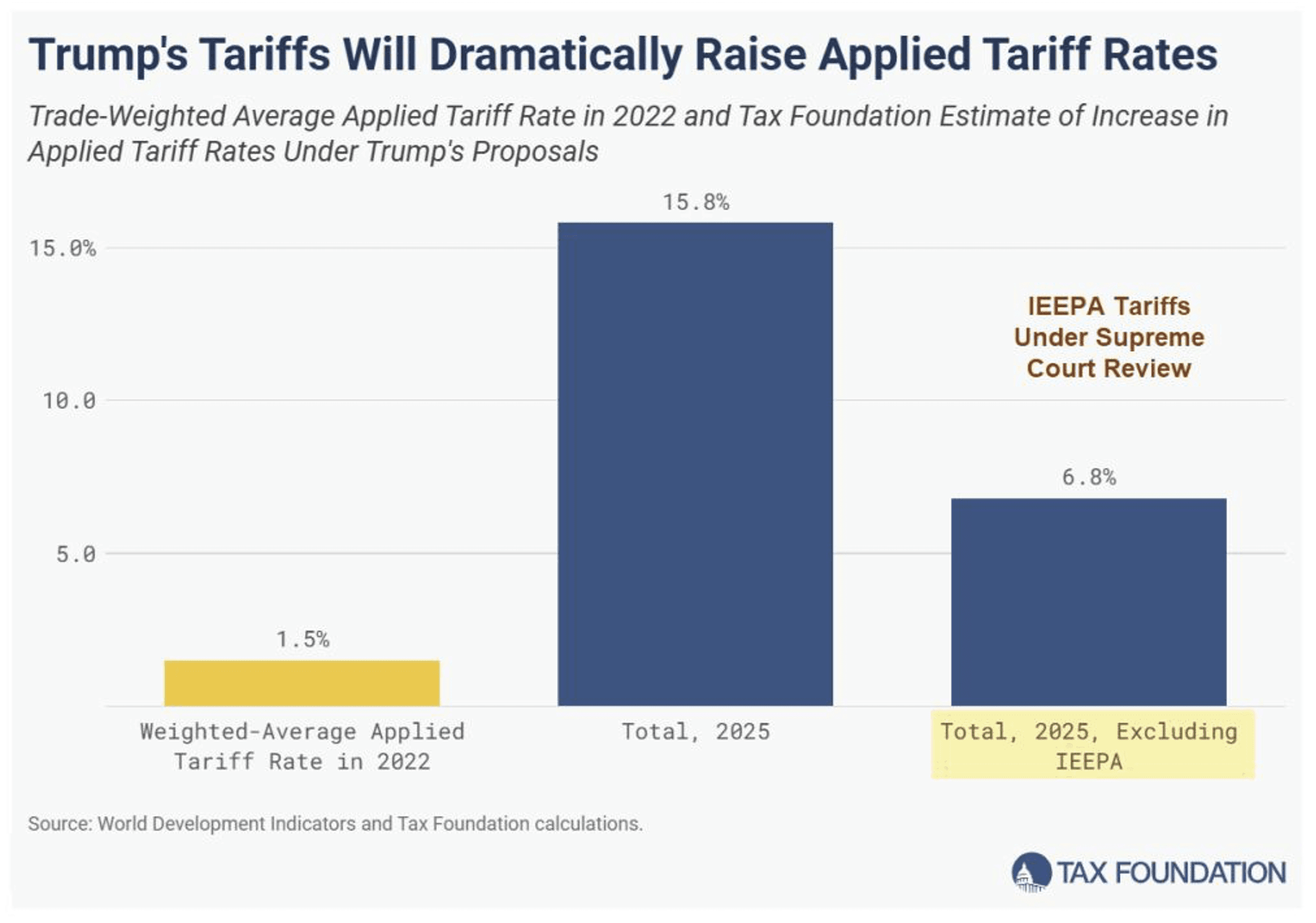

Wednesday is the next opinion day for the Supreme Court, which are days when it releases decisions, and its decision on the legality of the Trump administration’s tariffs that fall under the International Emergency Economic Powers Act (IEEPA) will be a market-moving event. Polymarket traders are pricing in a 75% chance that the Supreme Court rules against the tariffs. That is my expectation, and I think it would be met with a very bullish market reaction, because it would reduce the effective tariff rate on imports from approximately 16% to less than 7%. It could also lead to as much as $150 billion in refunds to companies that paid tariffs last year.

Regardless of the merits of tariffs, a Supreme Court ruling that lowers the effective rate would reduce business costs for US companies and remove what they say has been a headwind to job creation. The ruling itself, no matter the decision, could also be a positive from the standpoint that it ends the uncertainty that businesses say has stifled their plans to expand and invest.

Corporate Earnings Should Support Higher Stock Prices, Led By Small Caps

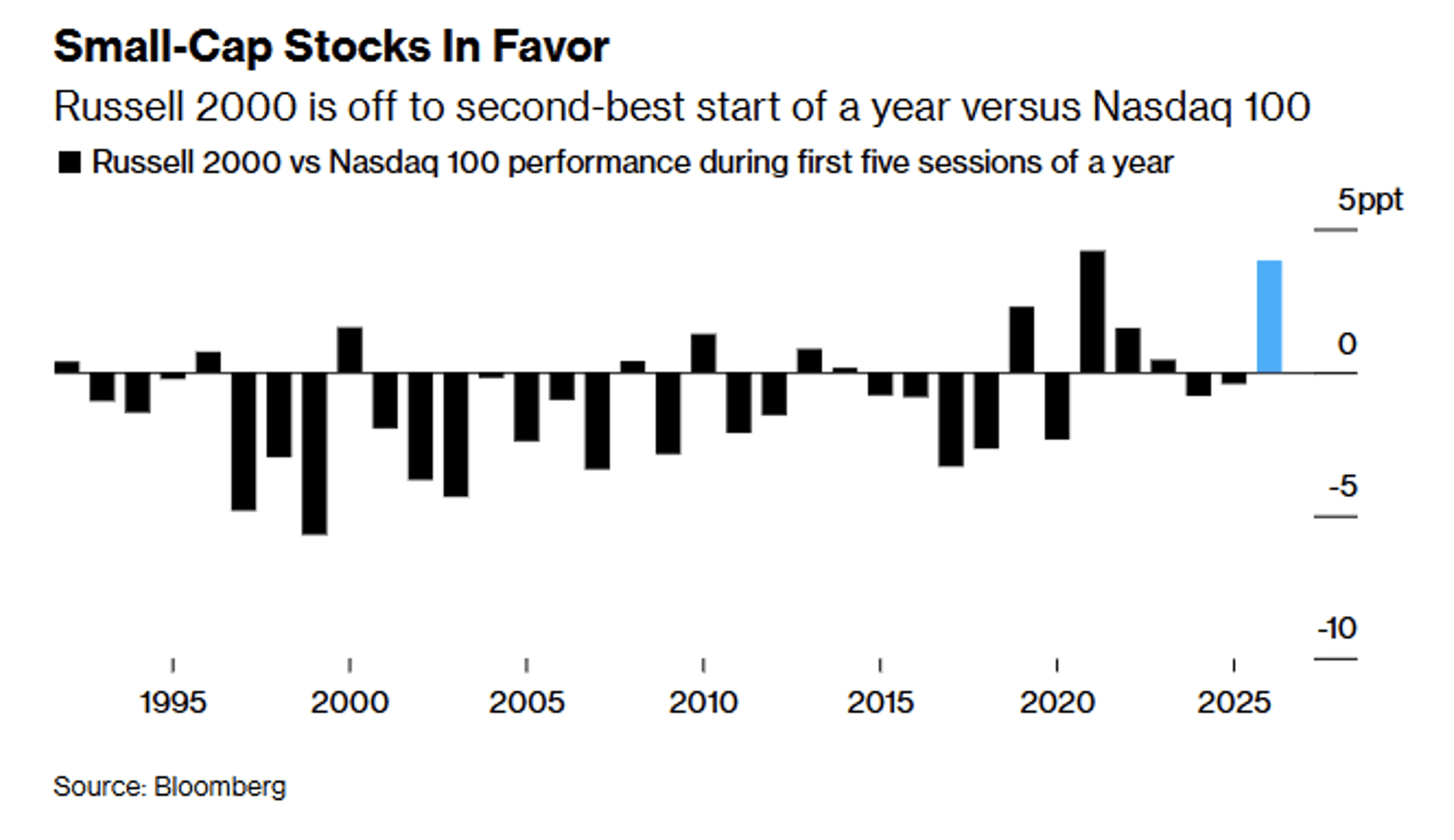

It has been a great start to the new year for stock investors with the Russell 2000 small-cap index outperforming the Nasdaq 100 by the largest percentage on record with the exception of 2021. This rotation from the technology sector, which has been the worst performer in the S&P 500 over the past month, into other sectors of the market is a healthy development that strengthens the foundation of the bull market. It is also consistent with the broadening in earnings growth. A significant improvement in market breadth, led by small to mid-sized companies, is one of my central investment themes for the fourth year of this bull market.

Stock prices correlate with earnings growth over time, and companies that produce the best earnings growth tend to have the best performing stocks. Earnings are a function of revenue growth and profit margins, and revenues and margins are dependent on the health of the overall economic expansion. This is why I spend so much time monitoring the high-frequency economic data and other developments that can impact the rate of economic growth. The labor market and the Supreme Court ruling on tariffs are just two examples.

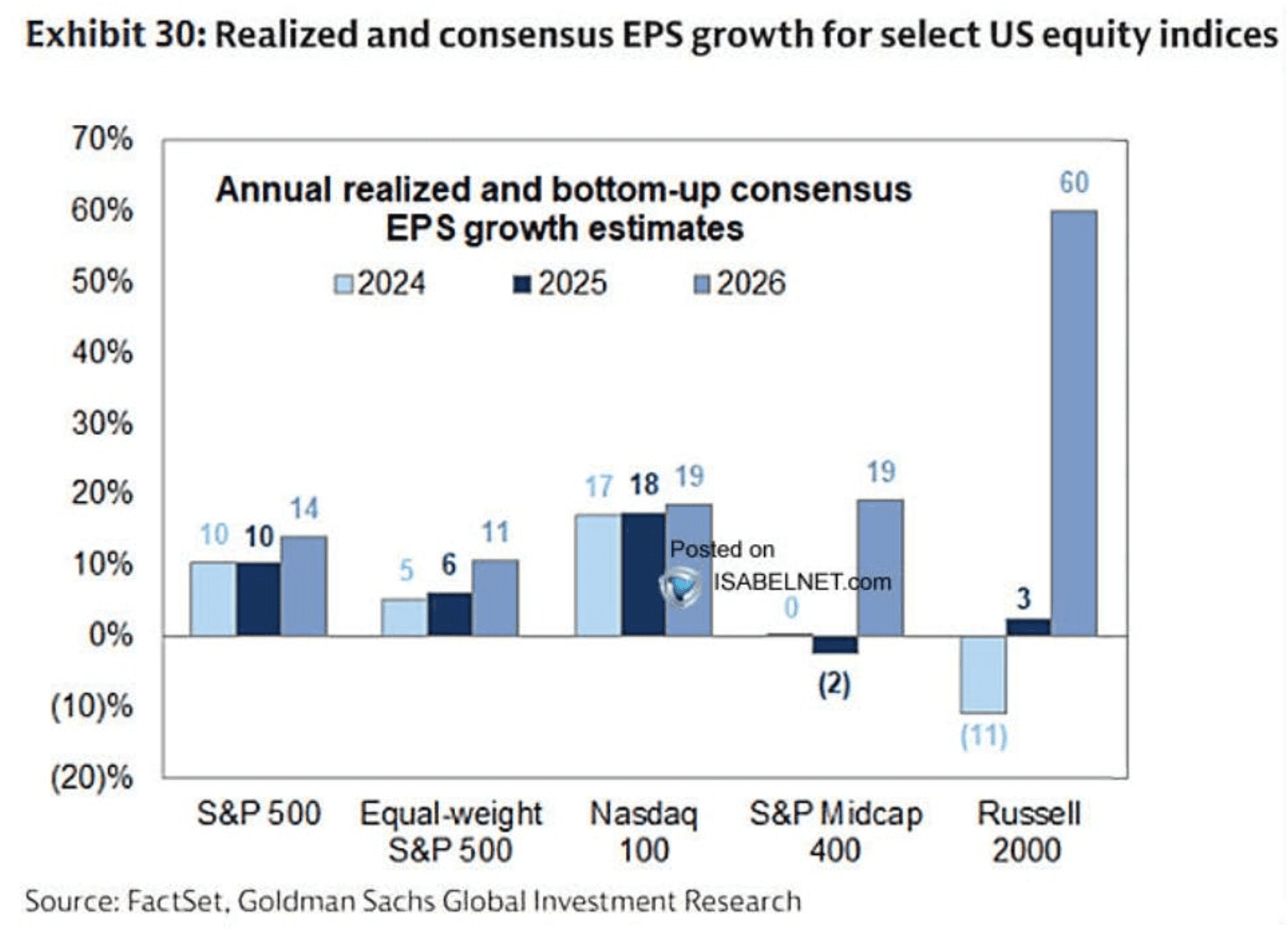

I have been sharing various forms of the chart below with investors over the past year in anticipation of the sector rotation we are seeing today. Markets respond to rates of change. Note that the rate of change in earnings growth for the technology sector (Nasdaq 100), although still strong, has slowed dramatically. It strengthens as we get smaller. Analysts are anticipating the most significant increase in earnings growth for small-cap stocks, and this started to be discounted in stock prices about six months ago. Small caps have outperformed technology stocks over the past six months with the Russell 2000 index rising 17.4% compared to the 12.6% increase for the Nasdaq 100 (QQQ). This is a trend I see continuing as the year progresses. If it continues, it suggests that investors should diversify across sectors and market caps, as the AI-fueled technology sector is no longer the only game in town.

PRECIOUS's inception date was April 22, 2024 and performance since inception was 115.5%. AIPOWER's inception date was September 2, 2025 and performance since inception was 33.0%. ANTICRAMER's inception date was December 12, 2024 and performance since inception was 27.6%. FASHION's inception date was June 25, 2024 and performance since inception was 50.7%. CRYPTOCORP's inception date was July 18, 2024 and performance since inception was 81.7%. This is not investment advice and is opinion only. Performance shown is gross of fees and does not include SEC and TAF fees paid by customers transacting in securities. Investing involves risk, including the potential loss of principal. The dub app is owned and operated by DASTA Inc. Advisory services provided by dub Advisors, an SEC registered investment advisor. Past Performance does not guarantee future results. For our general disclosures: https://support.dubapp.com/hc/en-us/articles/18018534403099-General-Disclaimer.

© 2026 DASTA Incorporated. All Rights Reserved. Performance shown is gross of fees and does not include SEC and TAF fees paid by customers transacting in securities. The dub app is owned and operated by DASTA Inc.. Advisory services provided by Dub Advisors, an SEC registered investment advisor. Past Performance does not guarantee future results. This content is provided for informational purposes only and is not intended as and may not be relied on in any manner as a recommendation or endorsement of any user, portfolio, thematic idea, or ESG factor offered by DASTA Incorporated (DBA “dub”) or its subsidiaries or affiliates (together “dub”). All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results, and investors should consider their own investment goals, risk tolerance, and financial situation before investing. The content herein is not warranted as to completeness or accuracy and is subject to change. The information presented, and its importance is an opinion only and should not be relied upon as the only important information available. The information may contain forward looking statements, including assumptions, estimates, projections, opinions, models and hypothetical performance analysis, which are inherently subjective. Changes thereto and/or consideration of different or additional factors could have a material impact on the statements made herein and Dub assumes no liability for the information provided. Advisory services provided by DASTA Investment, LLC (“Dub Advisors”), an SEC-registered investment adviser. Brokerage services provide by Dub Financial, LLC, and clearing and execution services by APEX Clearing Corporation (“Apex”), both SEC-registered broker-dealers and members of FINRA/SIPC. The registrations and memberships above in no way imply that the SEC, FINRA, or SIPC has endorsed the entities, products or services discussed herein. Additional Information is available upon request.