Rotation Is The Investment Theme For 2026

Jan 19, 2026

•

Lawrence Fuller

Small Caps Have A Record Run

It has been a daunting geopolitical news cycle for investors during the first two weeks of this year with threats to invade Greenland, the removal of President Maduro in Venezuela, concerns about the Fed’s independence and most recently the risk of a military attack on Iran. Uncertainty abounds, yet the stock market is an unbiased and fundamentally based discounting mechanism of future economic events, and it continues to indicate growth ahead.

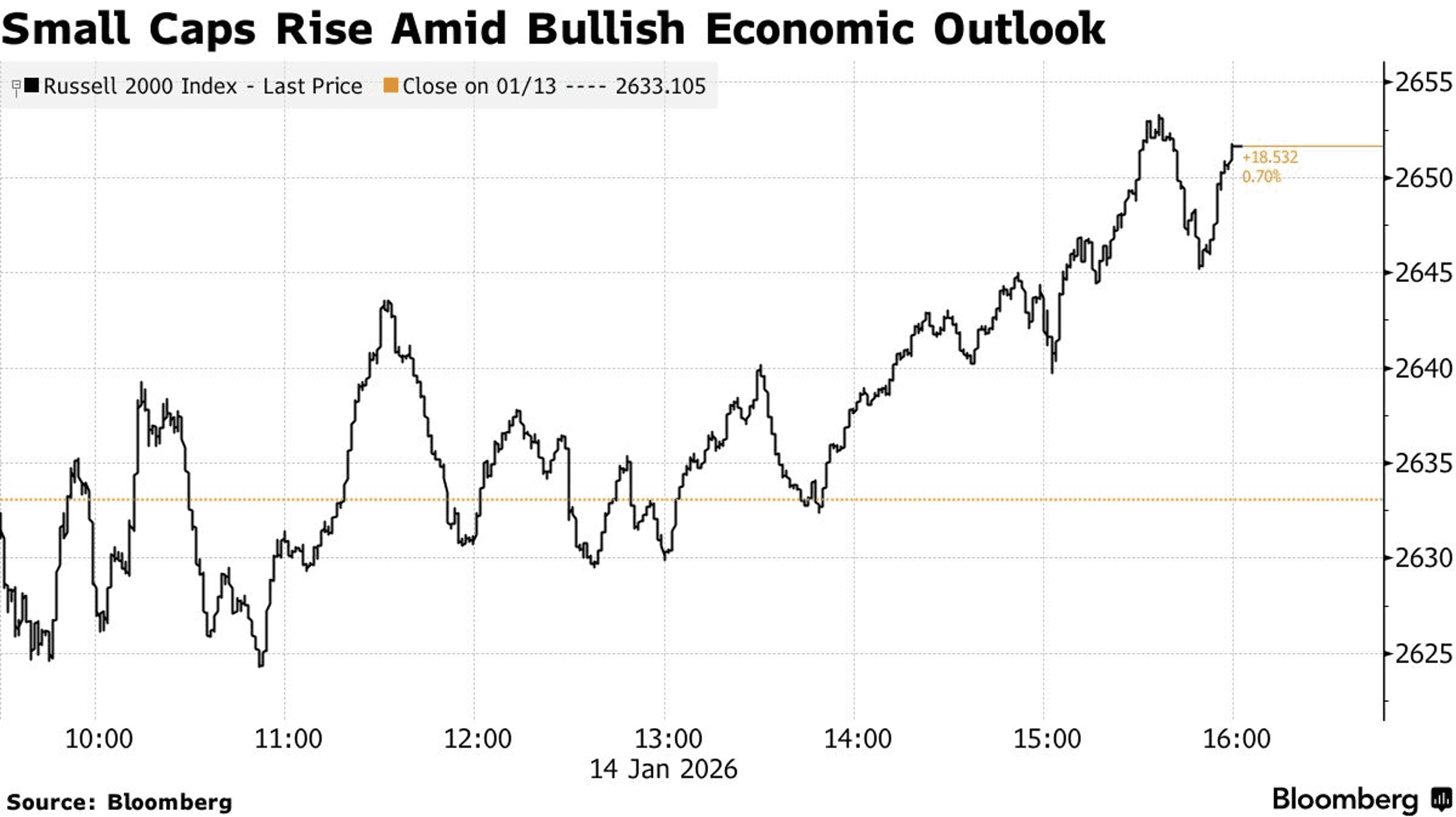

While maintaining year-to-date gains, the Dow Jones Industrials, S&P 500, and Nasdaq Composite edged lower last week with a twist, which is that the Russell 2000 small-cap index achieved a new all-time high on Friday. That twist is more of a rotation, which has been going on for several months now, as investors diversify out of expensive technology stocks and into other sectors of the market with more reasonable valuations and greater earnings growth prospects, led by smaller companies. This shouldn’t surprise readers of this newsletter. I asserted last November, during the first pullback we had seen since the correction low in April, that investors would rotate “out of high-growth names into defensive and more value-oriented sectors of the market,” which was “a healthy development that should help sustain the bull market into 2026. (November 17, 2023)”

While the technology-fueled Nasdaq Composite peaked last October, small caps have taken the baton with the Russell 2000 outperforming the S&P 500 for 11 days in a row through the end of last week. That is the longest winning streak since June 2008. Can it last? The leadership from small caps indicates investors are confident that the economic expansion is on sound footing, given their domestic focus. It also suggests more rate cuts are coming, as smaller companies tend to have greater leverage and are greater beneficiaries of lower borrowing costs. Yet this outperformance is primarily a function of earnings growth and valuations, as I’ve noted several times in the past.

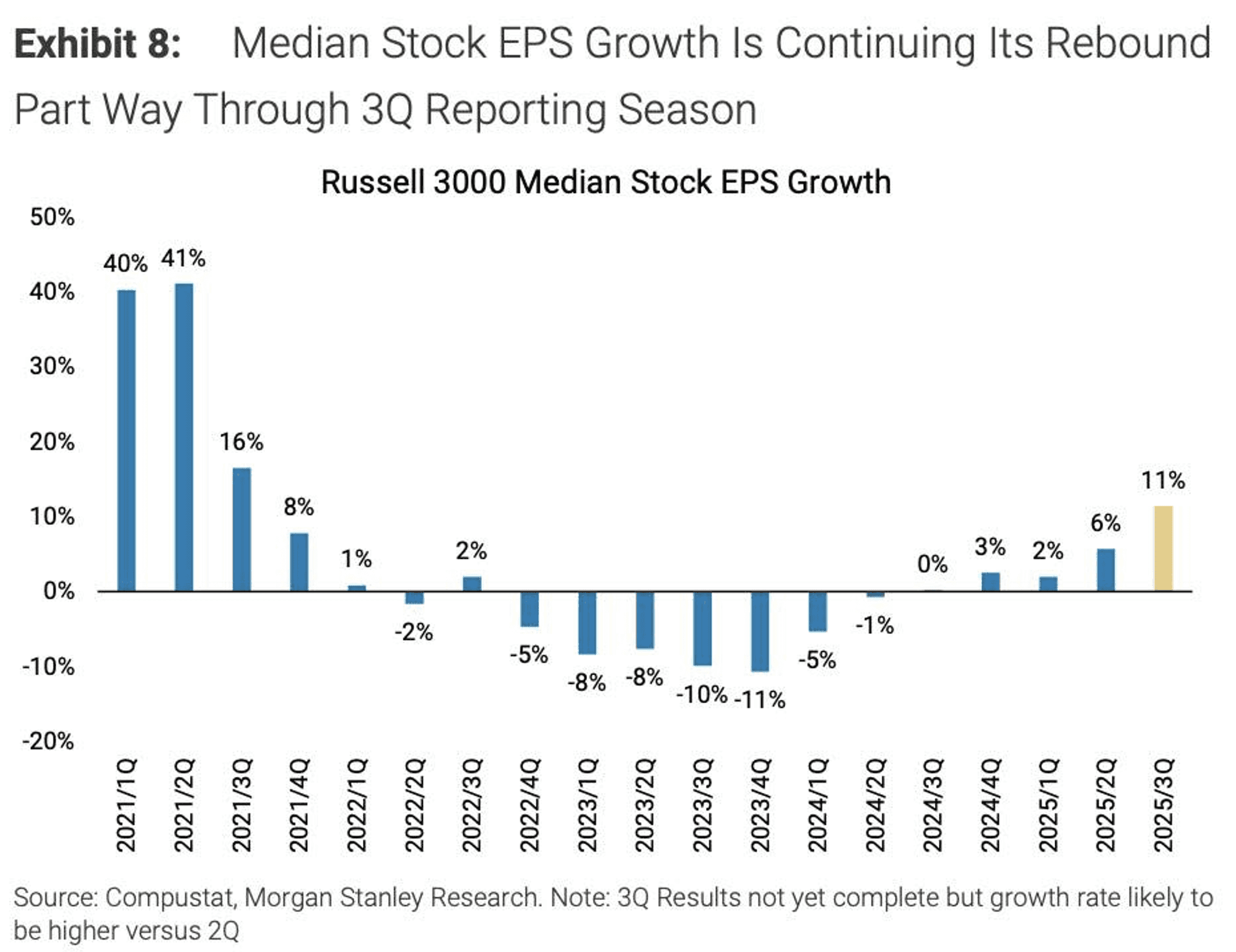

Stock Prices Track Earnings Growth

Stock price performance tends to track very closely with earnings growth over time. Since the introduction of ChatGPT in late 2022, earnings for the S&P 500 have grown approximately 27% on a cumulative basis, fueled largely by the AI investment buildout. Earnings for small cap stocks have been virtually flat. That equation started to change late last year, as the rate of earnings growth for the Nasdaq 100, led by the Magnificent 7, decelerated from its rampant pace in 2024 (+36.8%) to 2025 (18% expected). Meanwhile, earnings growth was accelerating for the rest of the market. As a precursor to the outperformance I expected from the average stock last November, led by small caps, I shared the chart below. It shows the significant increase in earnings growth expected for the median stock in the third quarter of last year, which is continuing into the fourth.

According to data aggregator FactSet, earnings are expected to grow 15% for the S&P 500 this year. Better yet, the S&P 400 mid-cap index is expected to realize growth of 17%, while the S&P 600 small-cap index is forecast to produce 19% growth. The Russell 2000 small-cap index, which includes companies with no profits, is expected to realize an increase in earnings of more than 60%. The accuracy of these numbers is not as important as the rates of change. That rate of change is what drives stock price performance, and it should be the overarching theme for 2026.

The Dangers Of Chasing Speculative Momentum

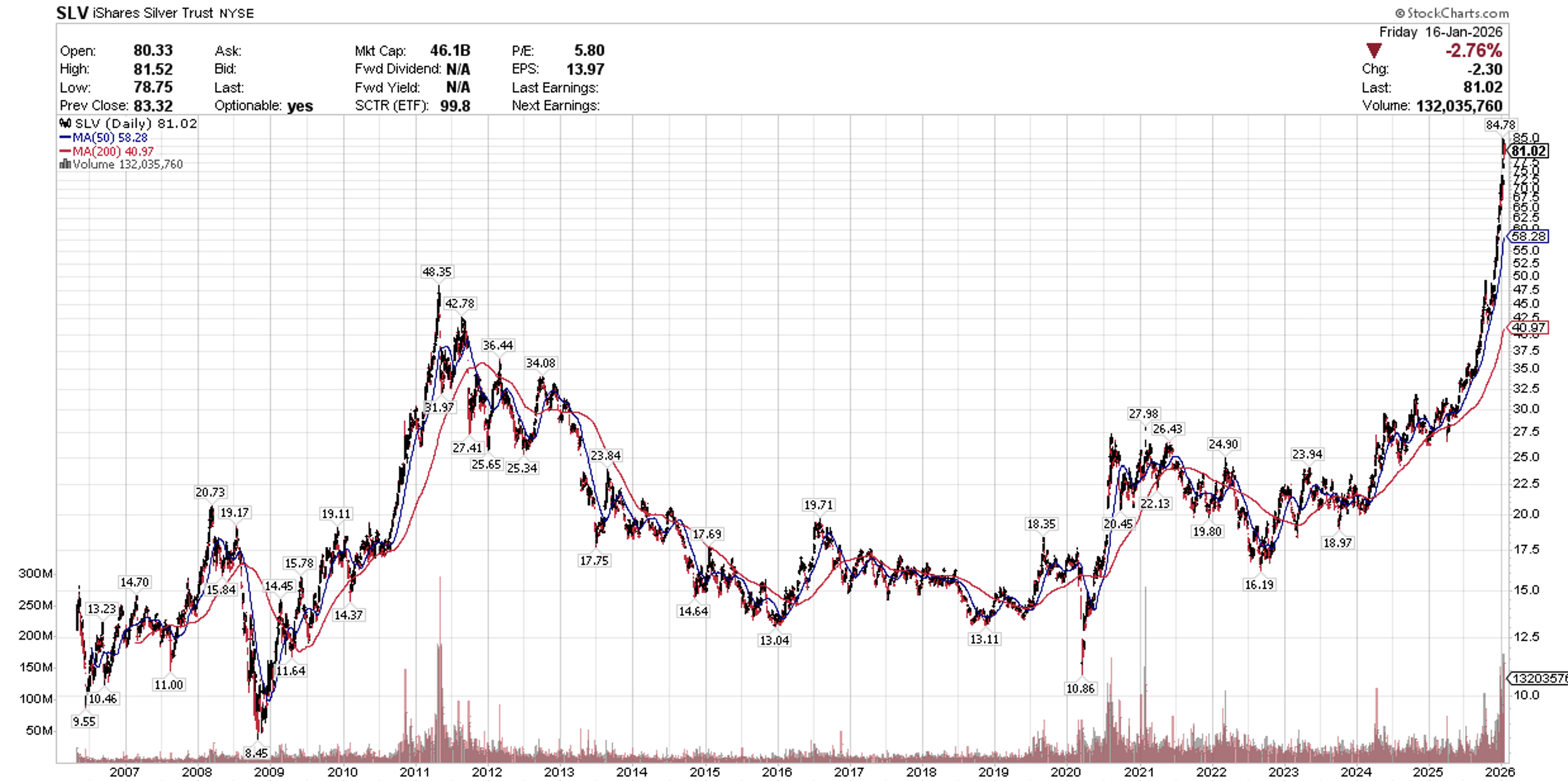

Precious metal prices have soared since last April shortly after President Trump announced his “reciprocal” tariff policy with silver prices more than tripling, due in part to the weakening of the US dollar. Additionally, central banks around the world have been increasing their gold reserves more aggressively, as they diversify their Treasury holdings. Speculatory have piled on. This melt up in gold and silver has been a welcomed development for portfolios that held either as core holdings in a diversified portfolio strategy. Yet on a more cautionary note, this run up has been parabolic to an extent I have not seen since the Great Financial Crisis in 2009 when the Fed implemented unprecedented monetary stimulus by lowering short-term rates to zero and buying record amounts of Treasuries and mortgage-backed securities. The peak came not long after, as the chart below reveals. I think the recent surge may have run its course, as prices appreciation is likely to slow dramatically if not reverse course.

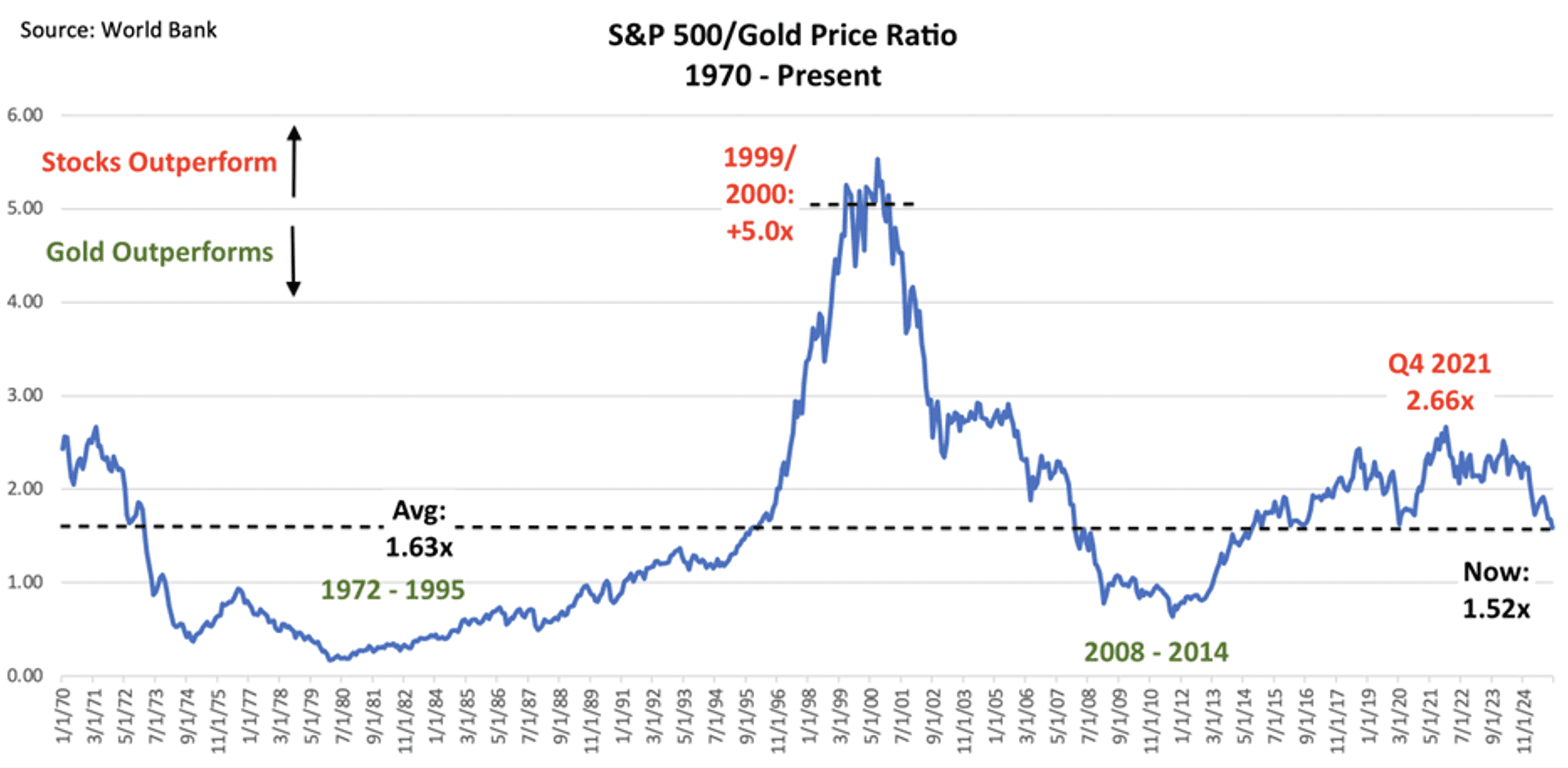

The chart below reflects the price ratio between gold and the S&P 500. When the ratio is falling, gold is outperforming the index, and when it is rising gold is underperforming. Today, it falls right on its long-term average, which suggests that for gold to continue outperforming the index we would likely need to see concerns about excessive stock valuations or global financial instability, as we did during the Great Financial Crisis or the hyper inflation of the early 1980s. That is not my outlook for the year ahead. Therefore, while precious metals should continue to serve as a valuable hedge in portfolios, their outside price appreciation is unlikely to continue.

Lawrence Fuller

Founder of Fuller Asset Management & dub Portfolio Creator SeekingAlpha Top Contributor (22k followers)

Background

With three decades of experience in portfolio management, Lawrence commenced his career at Merrill Lynch in 1993 and subsequently held similar roles at various Wall Street firms before establishing Fuller Asset Management in 2005. Since 2013, he has been an esteemed contributing writer for Seeking Akpha, authoring the widely followed Morning Brief newsletter, which boasts a dedicated readership exceeding 22,000 investors.

© 2026 DASTA Incorporated. All Rights Reserved. Performance shown is gross of fees and does not include SEC and TAF fees paid by customers transacting in securities. The dub app is owned and operated by DASTA Inc.. Advisory services provided by Dub Advisors, an SEC registered investment advisor. Past Performance does not guarantee future results. This content is provided for informational purposes only and is not intended as and may not be relied on in any manner as a recommendation or endorsement of any user, portfolio, thematic idea, or ESG factor offered by DASTA Incorporated (DBA “dub”) or its subsidiaries or affiliates (together “dub”). All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results, and investors should consider their own investment goals, risk tolerance, and financial situation before investing. The content herein is not warranted as to completeness or accuracy and is subject to change. The information presented, and its importance is an opinion only and should not be relied upon as the only important information available. The information may contain forward looking statements, including assumptions, estimates, projections, opinions, models and hypothetical performance analysis, which are inherently subjective. Changes thereto and/or consideration of different or additional factors could have a material impact on the statements made herein and Dub assumes no liability for the information provided. Advisory services provided by DASTA Investment, LLC (“Dub Advisors”), an SEC-registered investment adviser. Brokerage services provide by Dub Financial, LLC, and clearing and execution services by APEX Clearing Corporation (“Apex”), both SEC-registered broker-dealers and members of FINRA/SIPC. The registrations and memberships above in no way imply that the SEC, FINRA, or SIPC has endorsed the entities, products or services discussed herein. Additional Information is available upon request.